how much did you pay in taxes doordash

The correct answer to this question depends on a variety of factors including your tax bracket your income and the deductions and credits you are eligible for. When I filed my taxes I had to pay state and local taxes because doordash doesnt take anything out.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

90 of current year taxes.

. How much tax do I need to pay as a Doordash driver. All you need to do is track your mileage for taxes. If you earned more than 600 while working for DoorDash you are required to pay taxes.

To compensate for lost income you may have taken on some side jobs. Basic Deductions- mileage new phone phone bill. In 2020 the rate was 575 cents.

Im only paying 900 in taxes on my DoorDash earnings after making 26k last year. The subscription is 999month and you can cancel anytime with no strings attached. Lets Make Money eminemwithpeanuts Ahad the CPA Tax Expertahadthecpa 戦士w0r1dsmosthandsome Golden Earth Royaltygoldenearthroyalty ganaganadelrey.

Generally speaking however the IRS recommends that you pay at least 30 of your income in taxes. The self-employment tax is your Medicare and Social Security tax which totals 1530. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

Were working to make prices even lower to make DoorDash even more convenient and accessible so check back often. How much taxes do you pay with doordash. And 10000 in expenses reduces taxes by 2730.

That money you earned will be taxed. The first is your standard federal. How to record tiktok sounds with camera.

How Much to Pay DoorDash Taxes. Customers can also order from hundreds of restaurants in their area on the DoorDash platform via Pickup with zero fees. If you made 5000 in Q1 you should send in a Q1 payment voucher of 765 5000 x 0153.

I made about 7000 and paid maybe 200 in taxes after all the deductions. If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes. How much can you make on DoorDash without paying taxes.

How much do i pay in taxes on doordash 278K views Discover short videos related to how much do i pay in taxes on doordash on TikTok. Internal Revenue Service IRS and if required state tax departments. Didnt get a 1099.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Doordash only sends 1099 forms to dashers who made 600 or more in 2021. It doesnt apply only to DoorDash employees.

Average DoorDash Pay. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. No taxes are taken out of your DoorDash paycheck.

On average you can expect to make roughly 15 to 25 an hour. Hold i cant be your man. DoorDash mentions drivers make an average of around 20 per hour which is relatively accurate for most regular drivers who work for DoorDash.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. So if you drove 5000 miles for DoorDash your tax deduction would be 2875. If you earn more than 400 as a freelancer you must pay self-employed taxes.

A 1099 form differs from a W-2 which is the standard form issued to employees. Instead you must pay them yourself at tax time or if you make enough by making estimated tax payments throughout the year. Not very much after deductions.

There are several taxes that youll be responsible for as a DoorDasher. Answer 1 of 5. There is no fixed rule about this.

To avoid the estimated tax penalty you must pay one of the above percentages through a combination of estimated tax payments and withholding. For all the full-time dashes out there how much do you make in a year and how much did you owe in taxes. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022.

How Do Taxes Work with DoorDash. 110 of prior year taxes. Again keep in mind that your taxable income is the leftover of your revenue minus deductions.

I only dash part time and made about 5000 in 2020. As such it looks a little different. Yes - Just like everyone else youll need to pay taxes.

As such DoorDash doesnt withhold the taxes for you. Paying taxes for doordash. The forms are filed with the US.

With enough commitment you can easily earn up to 25 per hour. If youre a Dasher youll need this form to file your taxes. Thats 12 for income tax and 1530 in self-employment tax.

Watch popular content from the following creators. Dashers will not have their income withheld by the company to pay for these taxes so youll need to pay them on your own. From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income.

That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. 100 of prior year taxes. Any income that you earn including self-employment income from a gig marketplace like DoorDa.

AGI over 150000 75000 if married filing separate 100 of current year taxes. If you know what your doing then this job is almost tax free. Doordash not allowing refunds.

All income you earn from any source must be reported to the IRS and your states Department of Revenue. If you dont pay the quarterly estimated taxes you will be fined a small penalty when you file your taxes by April 15th. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate.

You have to deduct your revenue first.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

When Does Doordash Pay You Let S Find Out

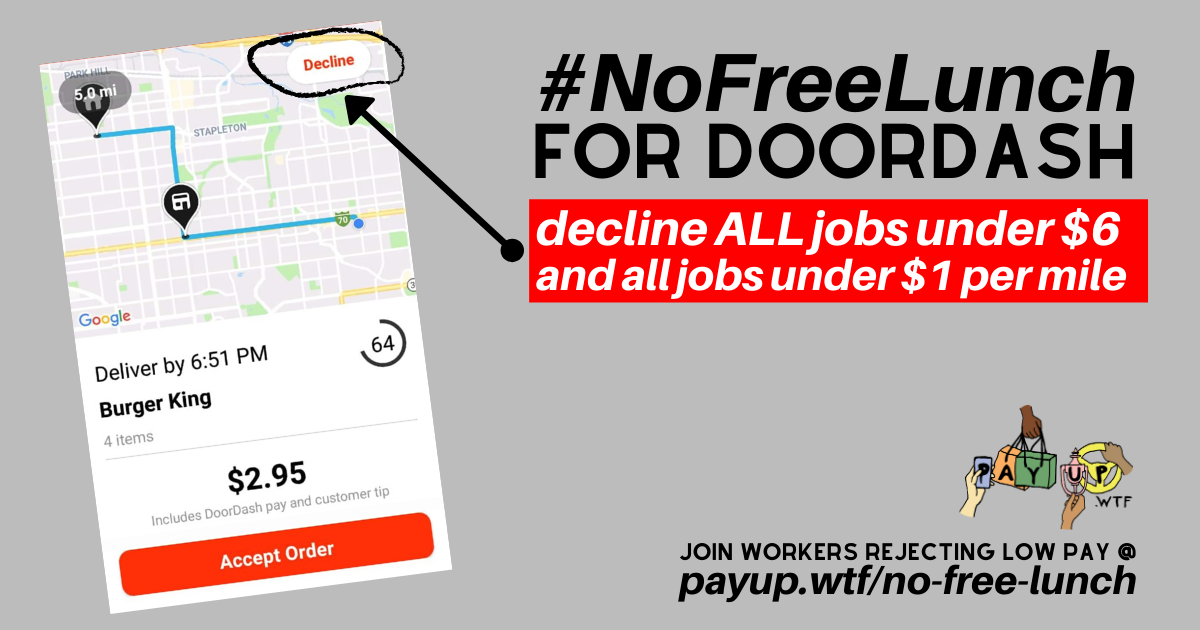

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup Doordash Payroll Taxes Algorithm

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Income Tax Federal Income Tax Tax

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

How Much Money Have You Made Using Doordash Quora

Become A Driver Deliver With Doordash Alternative To Hourly Jobs Hourly Jobs Money Making Jobs Doordash

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Delivering For Grubhub Vs Uber Eats Vs Doordash Vs Postmates Youtube Postmates Doordash Uber

13 Mistakes Doordash Drivers Should Avoid Doordash Drivers Mistakes

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax