green card exit tax rate

Tax evasion and conspiracy to defraud. Heres how the feds compute the Exit Tax Renouncing citizenship or giving up a green card can be expensive when it comes to the IRS.

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

. Exit tax when gives up a green card. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. The mark-to-market tax does not apply to the following.

Citizens or long-term residents. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. An exemption amount 699000 for expatriations in 2017.

Citizenship or long-term residency by non-citizens may trigger US. The net capital gains can be taxed at a maximum rate of 238 20 capital gain tax plus 38 net investment income tax. Status they are subject to the.

Yes corporate rates will go down to 20. The expatriation tax consists of two components. Green card taxes are required for green card holders.

The exit tax planning rules in the united states are complex. This amount is indexed for inflation is applied and any net capital gain above the exemption amount is taxed using the usual capital. You are a long-term resident which.

Green Card Exit Tax Rate. Thankfully this gain has a threshold limit. The Exit Tax Planning rules in the United States are complex.

The current maximum capital gains rate is 238 which includes the 20 capital. Citizens or long-term residents. Find the best ones near you.

A long-term resident is. Avvo has 97 of all lawyers in the US. Heres how the feds compute the Exit.

The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. If the gain is lesser than. This in turn requires either an administrative or judicial determination.

When a person is a covered. The expatriation tax rule only applies to US. The expatriation tax rule applies only to US.

The exit tax and the inheritance tax. Citizens who have renounced their. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

If you are neither of the two you dont have to worry about the exit tax.

Renouncing Us Citizenship Expat Tax Professionals

Renouncing Us Citizenship Expat Tax Professionals

Irs Tax Rules For Green Card Holders Filing U S Tax Returns

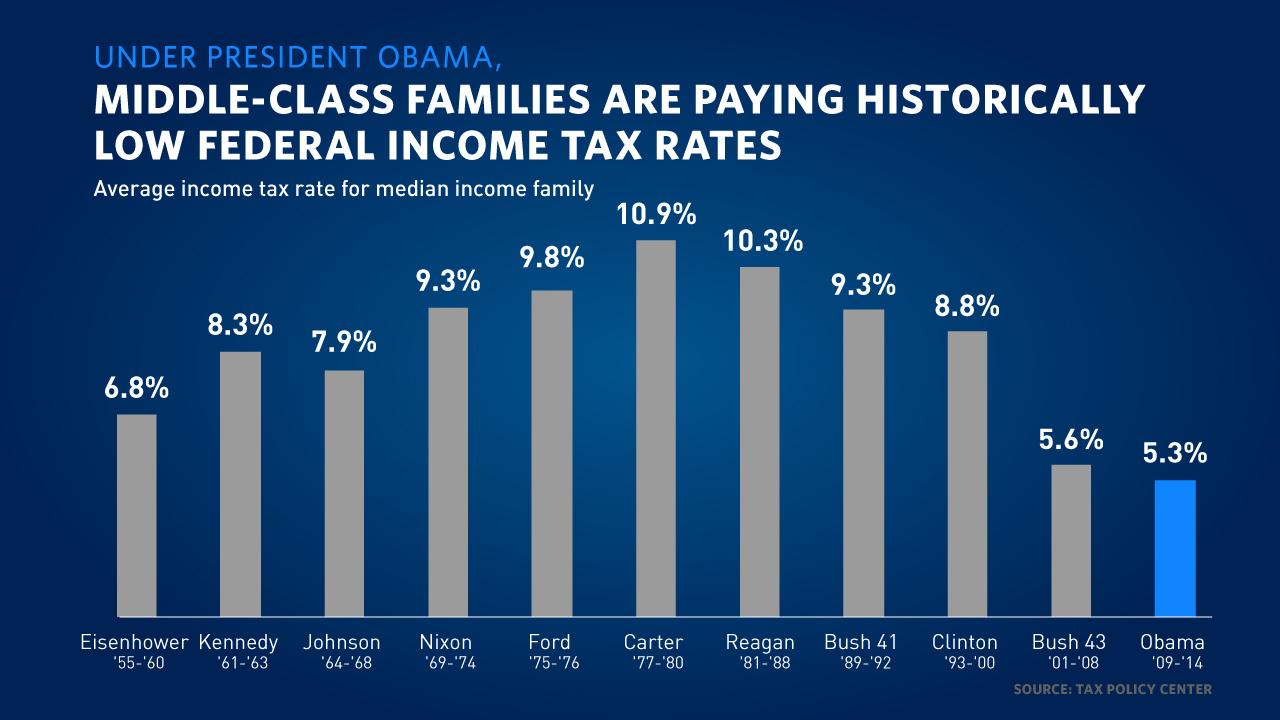

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

Exit Tax Archives The Wolf Group

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Frequently Asked Questions About The Us Tax Consequences Of Holding A Us Green Card And Surrendering One

Us Resident For Tax Purposes Faq Page 1040 Abroad

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Exit Tax 8 Years Long Term Residents Expatriation Permanent Residents Us Exit Tax Youtube

The Benefits Of A Green Card Boundless

The Tax Consequences Of Renouncing Us Citizenship

Us Exit Taxes The Price Of Renouncing Your Citizenship

2021 State Business Tax Climate Index Tax Foundation

The Taxes That Raise Your International Airfare Valuepenguin

The Taxes That Raise Your International Airfare Valuepenguin

Can You Pay Your Taxes With A Credit Card Yes And Here S How Cnn Underscored